Understanding the Funding Rate: What It Is and Why It Matters in Trading

The funding rate is a type of interest rate used in futures contracts. It ensures that the futures price stays close to the spot price. The funding rate is divided into two parts:

Positive Funding Rate: Long positions pay short positions.

Negative Funding Rate: Short positions pay long positions.

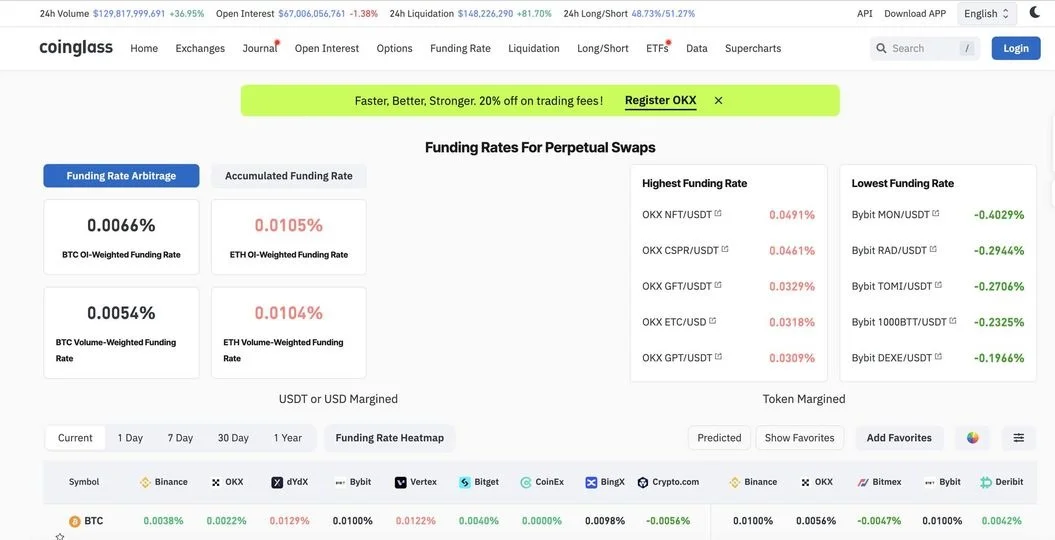

Picture Explanation

This picture shows the Bitcoin funding rate along with some other important metrics:

BTC OI-Weighted Funding Rate: 0.0066%

Meaning: Long positions are paying short positions at a rate of 0.0066%.

BTC Volume-Weighted Funding Rate: 0.0054%

Meaning: Long positions are also paying short positions, but this is a volume-weighted average.

ETH OI-Weighted Funding Rate: 0.0105%

Meaning: Ethereum's funding rate is also positive, with long positions paying short positions.

Highest Funding Rate: For example, the OKX NFT/USDT funding rate is 0.0491%, which is quite high.

Meaning: There is high demand for long positions, so they have to pay short positions.

Lowest Funding Rate: For example, the Bybit MON/USDT funding rate is -0.4029%, which is negative.

Meaning: Short positions are paying long positions because the demand for short positions is higher.

What Does This Mean for Traders?

Positive Funding Rate: If you hold a long position, you have to pay the funding rate. This increases your cost of holding the position.

Negative Funding Rate: If you hold a short position, you receive the funding rate. This means you get paid for holding the position.

Strategy:

- If the funding rate is consistently positive, shorting might be more profitable because long positions have to pay.

- If the funding rate is consistently negative, long positions might be more profitable because short positions have to pay.

Today's Recommendation

Current Funding Rate: 0.0038% on Binance for BTC.

Positive Funding Rate: This means there are more long positions.

Shorting Opportunity: If you want to short, this could be a good time because the funding rate is positive, and longs are paying shorts.

Conclusion

The Bitcoin funding rate gives traders an indication of where the demand is higher, allowing them to adjust their strategies accordingly. A positive funding rate means there are more long positions, and they have to pay short positions. A negative funding rate means there are more short positions, and they have to pay long positions.

Bitcoin Funding Rate Explanation

The Bitcoin funding rate is the rate that long and short position holders pay each other to keep the price of perpetual futures contracts close to the spot market price. If the funding rate is positive, long position holders pay short position holders. If it is negative, short position holders pay long position holders.

In this image, the funding rates across different exchanges are shown. On the left side, the OI-Weighted and Volume-Weighted funding rates for BTC and ETH are given, which are average rates across various exchanges. On the right side, the highest and lowest funding rates are highlighted, showing which pairs have the highest or lowest funding rates.

For traders, this means that if they hold long or short positions, they will have to pay or receive these rates depending on their positions. This information can help them in decision-making, determining when and where to trade to take advantage of or avoid the funding rate.

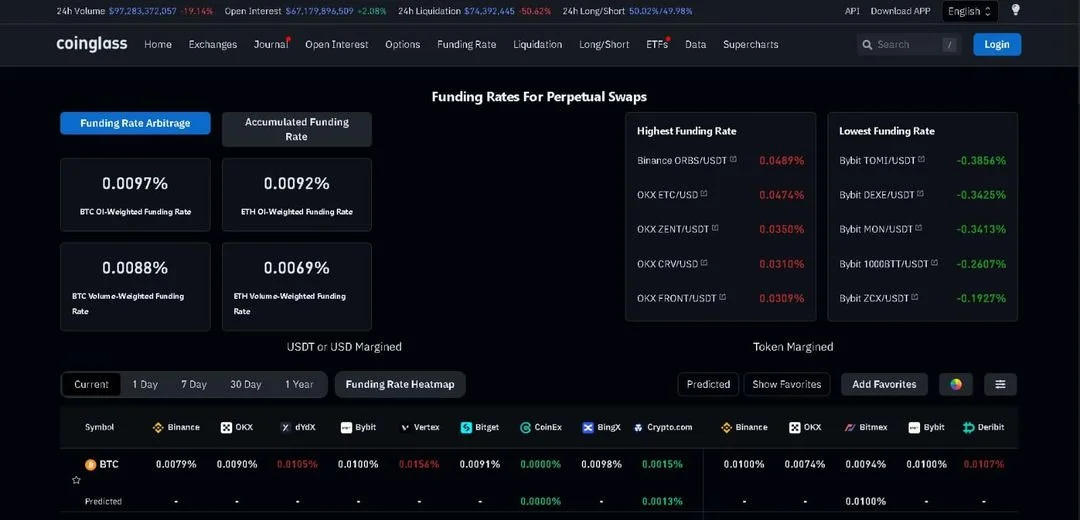

Bitcoin Funding Rate Explanation (30 July 2024, 1:20 AM Pak Time)

The funding rate means that perpetual futures contract holders, long (buy) and short (sell), regularly pay each other. This rate can be positive or negative. If the rate is positive, long position holders pay short position holders. If it is negative, short position holders pay long position holders.

The Bitcoin funding rate on different exchanges is shown as follows:

- Binance BTC/USDT Funding Rate (USDⓈ-M): 0.0090%

- Binance BTC/USD Funding Rate (COIN-M): 0.0100%

- Bybit BTC/USDT Funding Rate (Token-M): 0.0090%

- OKX BTC/USDT Funding Rate (Token-M): -0.0096%

This means that on Binance and Bybit, the funding rate is positive, indicating that more people are holding long positions and paying short position holders. On OKX, the funding rate is negative, meaning short position holders are paying long position holders.

For traders, this funding rate is important because it affects their cost or earnings, especially when holding long-term positions. A positive funding rate means the market has a bullish sentiment with more people betting on the buy side. A negative funding rate indicates a bearish sentiment where more people are betting on the sell side.