Understanding the Current Market Crash: A Global Perspective

The global financial markets are currently experiencing a significant downturn, impacting stocks, cryptocurrencies, and other assets. Investors worldwide are concerned as they witness widespread declines across various markets. In this blog, we'll explore the reasons behind this market crash, with a special focus on the Japanese stock market, the influence of interest rates, and the ripple effects on cryptocurrencies like Bitcoin (BTC). This comprehensive analysis also includes insights into the latest Indian crypto news, Pakistan crypto news, and how these developments impact the global crypto ecosystem.

The Global Market Downturn

1. Economic Uncertainty and Slowdown:

- Global Economic Slowdown: The global economy has shown signs of slowing growth, with reduced consumer spending, industrial production, and trade volumes. Factors such as geopolitical tensions, trade disputes, and ongoing supply chain disruptions contribute to this uncertainty, as reported in various crypto news feeds and Google crypto news.

- Pandemic Aftershocks: The lingering effects of the COVID-19 pandemic continue to weigh on economies, with uneven recovery rates across different regions. Emerging markets, in particular, face challenges such as slower vaccine rollouts and limited fiscal capacity to support growth. These factors have also been highlighted in the best crypto news sites.

2. Inflation and Interest Rates:

- Rising Inflation: Many countries are experiencing higher inflation rates, driven by increased energy costs, supply chain disruptions, and pent-up demand. Central banks are responding by tightening monetary policies, which has been covered extensively in breaking crypto news.

- Interest Rate Hikes: To combat inflation, central banks in major economies, including the United States, the Eurozone, and Japan, have signaled or implemented interest rate hikes. Higher interest rates typically lead to increased borrowing costs, reducing consumer spending and corporate investment, ultimately slowing economic growth. This trend has been a focal point in all crypto news and traditional financial updates.

3. Market Sentiment and Investor Behavior:

- Risk Aversion: Investors are becoming more risk-averse due to the uncertain economic environment. They are pulling back from riskier assets such as stocks and cryptocurrencies, opting for safer investments like bonds and gold. This shift is often discussed in the best place to get crypto news.

- Profit-Taking: After a prolonged period of market gains, some investors are taking profits, contributing to market sell-offs. This behavior has been noted in crypto price news and various crypto exchange news updates.

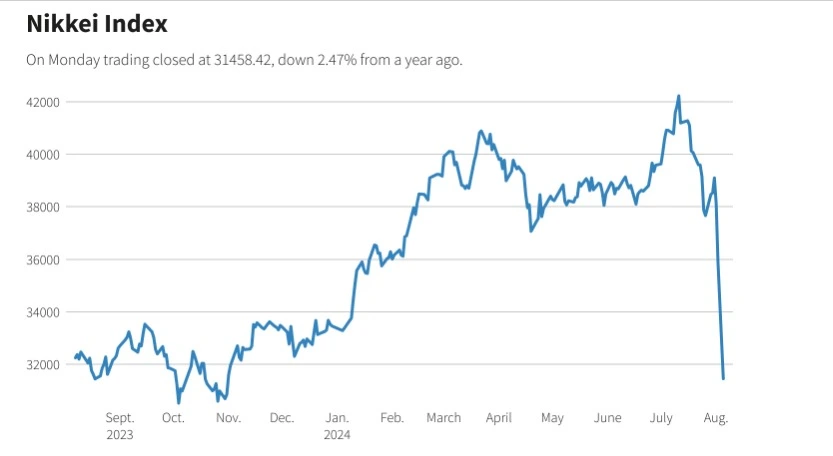

Focus on Japan: The Stock Market Decline

The Japanese stock market has not been immune to the global downturn. Several factors contribute to the decline:

1. Sluggish Economic Growth:

- Japan's economy has been grappling with slow growth for years, compounded by an aging population and low birth rates. The country has struggled to achieve sustained economic expansion, making it vulnerable to global economic shocks, a topic frequently covered in the best crypto news websites.

2. Export Dependency:

- Japan's economy heavily relies on exports. The slowdown in global demand, particularly from key trading partners like China and the United States, has hurt Japanese exports. Supply chain disruptions have further exacerbated the situation, as seen in the latest crypto upcoming news.

3. Interest Rates and Monetary Policy:

- The Bank of Japan (BOJ) has maintained an ultra-loose monetary policy for years, keeping interest rates near zero. However, the global trend of rising interest rates has put pressure on the BOJ to consider tightening its policy. This has created uncertainty in the market, as investors anticipate changes in the cost of borrowing and the potential impact on corporate profits. This uncertainty has been a significant factor in crypto coin news and traditional market reports.

Cryptocurrencies: Bitcoin's Decline

The cryptocurrency market, including Bitcoin (BTC), has not been spared from the broader market downturn. Several factors contribute to the decline:

1. Macro-Economic Factors:

- The same macroeconomic factors affecting traditional markets, such as inflation concerns and interest rate hikes, also impact cryptocurrencies. Investors view digital assets as high-risk, and rising interest rates make traditional assets like bonds more attractive. These dynamics are often discussed in the best crypto news app and crypto news hub.

2. Regulatory Uncertainty:

- Increased regulatory scrutiny in major markets like the United States and China has created uncertainty around the future of cryptocurrencies. This regulatory risk has led to market volatility and investor caution, frequently highlighted in Indian crypto news and Pakistan crypto news.

3. Market Sentiment and Liquidity:

- The cryptocurrency market is highly sentiment-driven, and negative news can lead to sharp price declines. Additionally, the market's relatively low liquidity compared to traditional financial markets can exacerbate price swings. This has been a common theme in crypto news today Hindi and latest crypto mining news.

Conclusion

The current market crash is a complex phenomenon driven by a combination of global economic factors, investor sentiment, and specific regional challenges. While the downturn may be unsettling, it's essential to understand that market corrections are a natural part of the economic cycle. Investors should remain cautious, stay informed, and consider long-term strategies to navigate these turbulent times.

As always, it's crucial to consult with financial advisors and conduct thorough research before making any investment decisions. Stay tuned to DailyCoinMarket for the latest updates and analysis on global markets and cryptocurrencies, including the most recent crypto faucet updates and insights from the best crypto news sources.