U.S. Regulators Postpone Decision on Hashdex Nasdaq Crypto Index ETF Listing

U.S. regulators have delayed their decision on whether to allow the Hashdex Nasdaq Crypto Index ETF to list on Nasdaq’s electronic securities exchange. This ETF, if approved, would be groundbreaking as the first U.S. fund to offer a diversified portfolio of spot cryptocurrencies, marking a significant milestone for the crypto market.

Key Points:

- Regulatory Delay:

- Postponed Decision: On August 9, 2024, U.S. regulators announced that more time is needed to evaluate Nasdaq's request to list the Hashdex Nasdaq Crypto Index ETF. This decision comes two months after Nasdaq submitted the request in June.

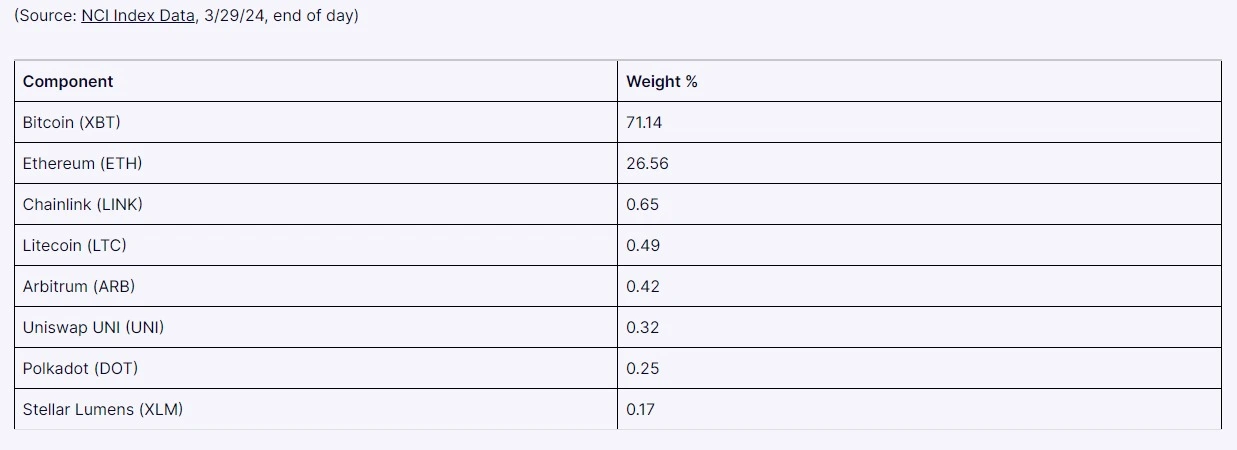

- First of Its Kind: If approved, the Hashdex Nasdaq Crypto Index ETF would be the first ETF in the U.S. to hold a diversified portfolio of spot cryptocurrencies, including major assets like Bitcoin (BTC) and Ethereum (ETH), along with altcoins such as Chainlink (LINK) and Uniswap (UNI).

- Nasdaq Crypto US Index (NCIUS):

- Diverse Holdings: The ETF is designed to track the Nasdaq Crypto US Index (NCIUS), which features a mix of cryptocurrencies weighted by market capitalization. The portfolio includes core assets like BTC and ETH, which make up approximately 95% of the index, as well as other altcoins.

- Market Impact: This ETF would allow investors to gain exposure to a wide range of cryptocurrencies through a single investment vehicle, potentially increasing mainstream adoption of digital assets.

- SEC's Role:

- Approval Process: Before the ETF can be listed, the Securities and Exchange Commission (SEC) must approve its registration application (S-1) and allow it to be traded on a public equities exchange such as Nasdaq.

- Previous Filings: In a related development, Nasdaq recently submitted a similar request to list options on Ethereum ETFs, which is also under consideration by the SEC.

Conclusion: The delayed decision on the Hashdex Nasdaq Crypto Index ETF highlights the cautious approach U.S. regulators are taking towards cryptocurrency-based financial products. If approved, this ETF could revolutionize how investors access the crypto market, providing a diverse and regulated investment option. As the SEC continues to evaluate these proposals, the crypto industry eagerly awaits a potential breakthrough in mainstream financial adoption.