Crypto Market Panic: $2 Trillion Wiped Out as Bitcoin, Ethereum, Solana, XRP, and Dogecoin Face Extreme Volatility

The cryptocurrency market has been rocked by a sudden and severe crash, wiping out $2 trillion in market value as extreme fear spreads among investors. Major cryptocurrencies, including Bitcoin, Ethereum, Solana, XRP, BNB, and Dogecoin, have all experienced significant declines following warnings from top financial institutions.

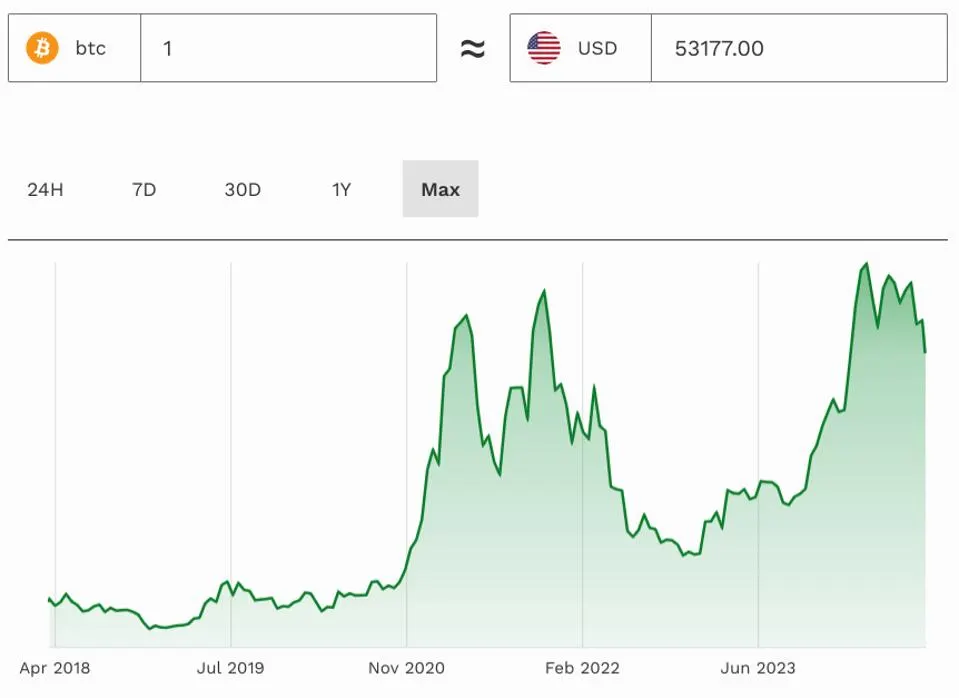

Bitcoin, the market leader, has plunged toward the $50,000 mark, with the overall crypto market falling below the $2 trillion threshold. The drop comes amid rising concerns that the U.S. dollar is teetering on the edge of a total collapse, exacerbated by disappointing U.S. jobs data that failed to meet expectations.

Market Sentiment Turns to Extreme Fear

The crypto market's sentiment has shifted dramatically to "extreme fear," as reflected by the Crypto Fear & Greed Index, which has plummeted to a one-month low of 22. This level of fear was last observed during the market meltdown in August, raising alarms about further potential losses.

The sharp decline was triggered by a serious warning from Goldman Sachs, which cautioned about the potential for a market-wide crash. The Bitcoin price briefly dropped below the key support level of $53,000 before a minor rebound, but the outlook remains grim. Other top cryptocurrencies have followed suit, with Ethereum, Solana, XRP, and Dogecoin all losing between 5% and 10% in the last 24 hours.

U.S. Jobs Data Fuels Fed Rate Cut Speculation

The latest U.S. jobs report, which revealed the addition of only 142,000 new jobs in August—falling short of the expected 161,000—has fueled speculation that the Federal Reserve may have delayed interest rate cuts for too long. This has heightened fears of a potential recession, further destabilizing the market.

Despite the negative sentiment, some analysts believe that a forthcoming interest rate cut from the Fed could act as a bullish catalyst for the crypto market. Leena ElDeeb, a research analyst at 21Shares, commented, "A rate cut bodes well for risk-on assets like Bitcoin, which have historically benefited from increased investor appetite as borrowing costs decrease. If the economy avoids a hard landing, we could see a resurgence in the crypto market in the fourth quarter."

What’s Next for the Crypto Market?

As the crypto market continues to grapple with these uncertainties, investors are advised to remain cautious. The looming threat of a deeper market correction remains, and the potential for further volatility is high.

For those interested in staying ahead of the curve, subscribe to our free daily newsletter, Crypto Insights, for the latest updates and expert analysis on the ever-changing world of cryptocurrency.

Explore More:

- Why Bitcoin Prices Are Falling: An in-depth look at the factors driving Bitcoin's recent decline.

- Ethereum's Struggle: What the future holds for the second-largest cryptocurrency.

- Federal Reserve's Impact on Crypto: How the Fed's decisions could shape the crypto landscape.